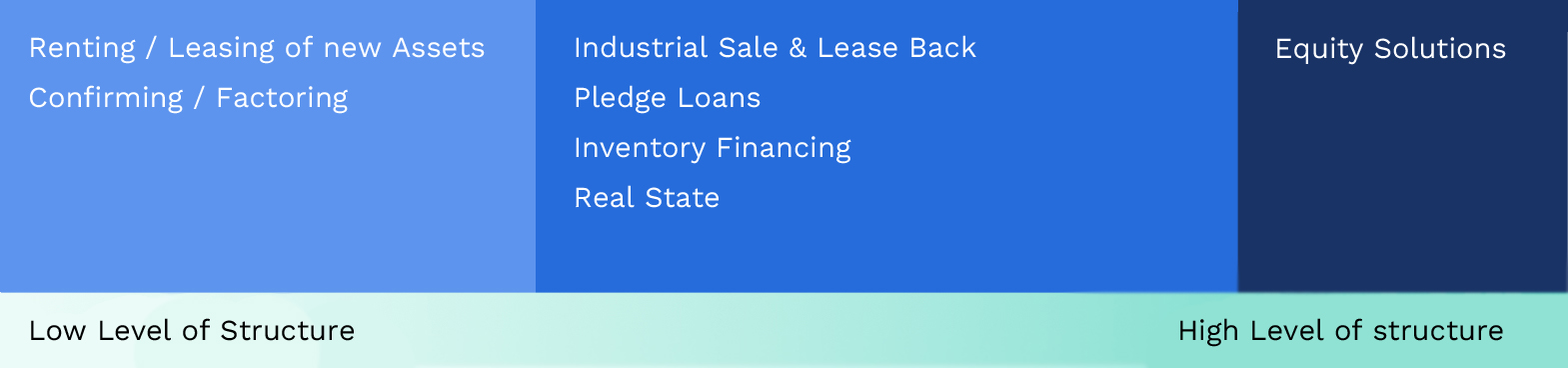

“Multi-platform” Model

LB offers a “Multi-Platform” model which allows us to broadly cover the needs of each of our clients. We have several financial structures that allow us to customize and adjust our financing solution to the unique needs and characteristics of each operation.

Rather than offering a generic solution, we strive to understand the specific goals and challenges of each project and create a customized financing plan that meets your requirements. In this way, we can provide an effective and efficient financing solution for each operation.

How it works

Various Sale & Lease Back structures and mortgages. Minimum amount of €3M and minimum term of 10 years. Preferably multi-purpose properties.

Features

of the financing:

Amount: From €3M

Time frame: 4 to 8 years

Collateral: Different types of real estate, industrial and logistic buildings, commercial real estate, etc.

LTV: Up to a maximum of 85%

Location of Assets: Spain, Portugal, France and/or Benelux

Operation Structure: Sale & Lease Back, Direct Renting and Direct Lending, flexible, with the possibility of grace period and balloon of up to 30%.

LB Financing

Advantages

A successful alternative financing system, with access to large international funds. A successful alternative financing system, with access to large international funds.

Our Value in

Operations

Operational simplicity

Customer orientation

Flexible volumes

Flexible pricing

Monetization of assets

Professionalism and experience

Product Flexibility

- Possibility of obtaining immediate liquidity by valuing the production equipment in use.

- Flexible and tailor-made structures, adapting operations to the needs of the company and its assets (useful life, value over time, etc.).

- The volume of operations can move in a really wide range: from €0.1M with no limit above.

- Really advantageous repayment terms: up to 7 years, including grace period or bullet/balloon payments.

- Disbursement of up to 100% of the cost price + VAT of the asset; up to 85% of the appraised value in Sale & Lease-back cases.

Favorable Conditions

- Alternative source of financing outside the traditional banking perimeter: it does not consume bank risk lines and in most cases, it is outside CIRBE.

- We release classic collateral such as real estate or accounts receivable.

- Good option to diversify financing providers.

- A good alternative to other more complex and difficult to access financing methods or with higher costs, such as bonds.

- Useful for the renewal of the industrial park, allowing the replacement of obsolete assets with state-of-the-art technology.